🚀 Design for tomorrow: Explore MDEF!

New stories 👀 Read all about them!

Join us at 📍 FAB25 Czechia July 4–11 Brno & Prague!

🚀 Design for tomorrow: Explore MDEF!

New stories 👀 Read all about them!

Join us at 📍 FAB25 Czechia July 4–11 Brno & Prague!

We are a research and education centre rethinking the way we live, work and play!

Education Programs

In house programs

Master in Design for Emergent Futures – MDEF

Challenge the Way Things Work Today, Design for Tomorrow

In house programs

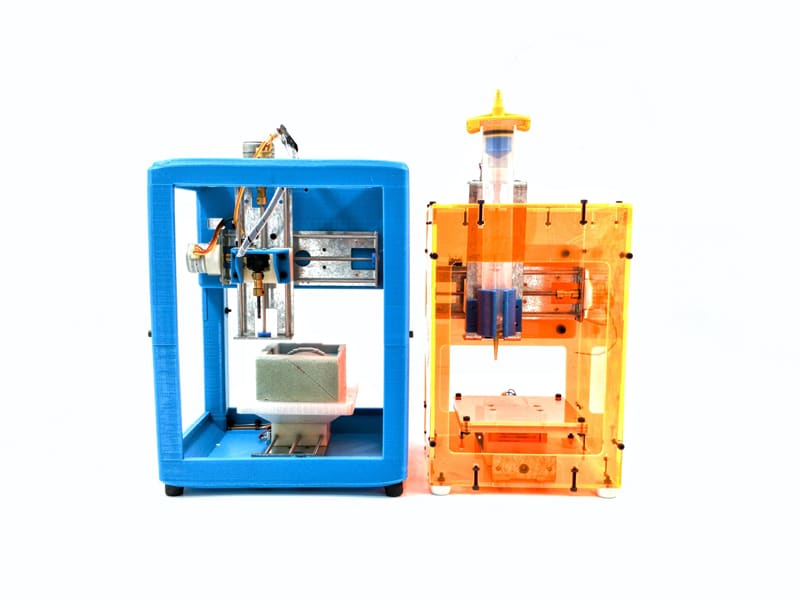

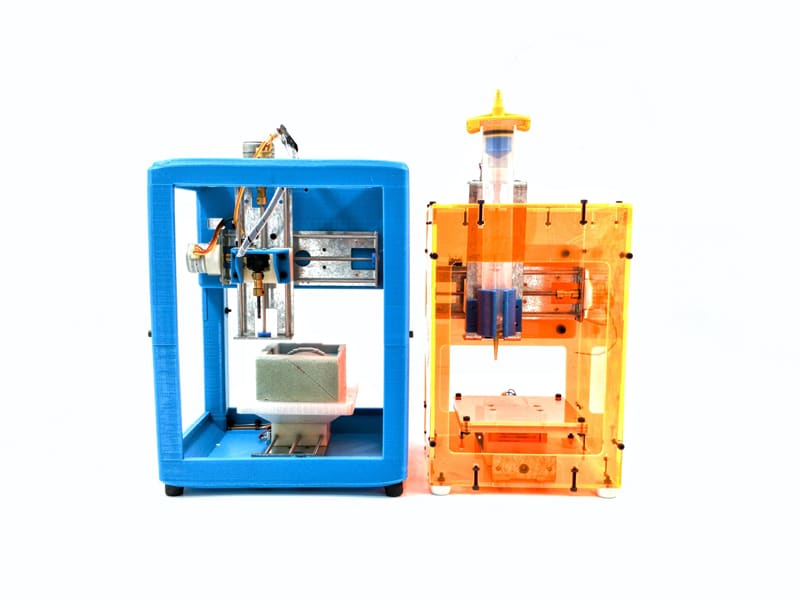

Postgraduate in Digital Fabrication – Fab Academy BCN

Hands-on learning experience and learn rapid-prototyping.

Our latest projects

Hot from the blog

Stay in the loop

RESOURCE

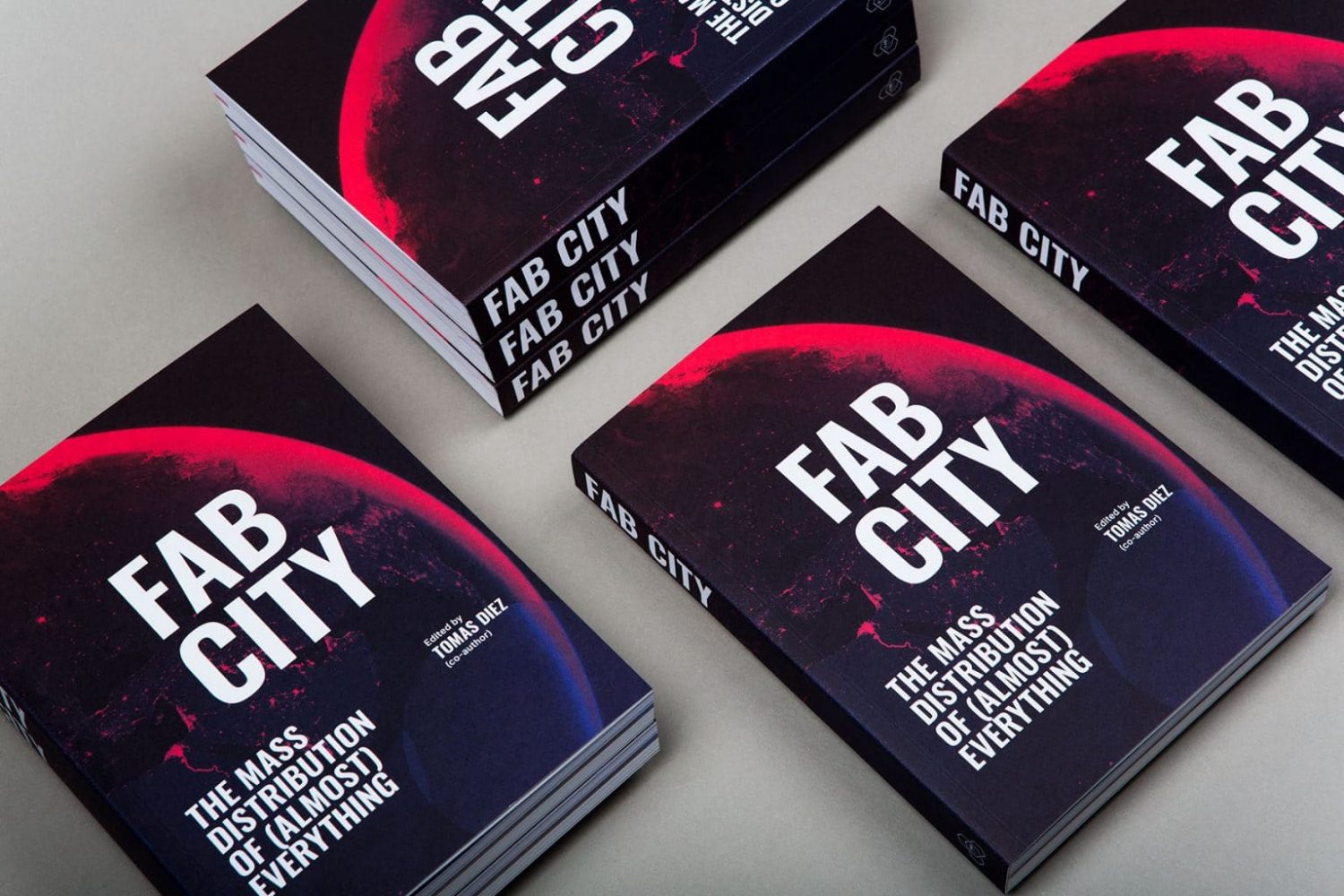

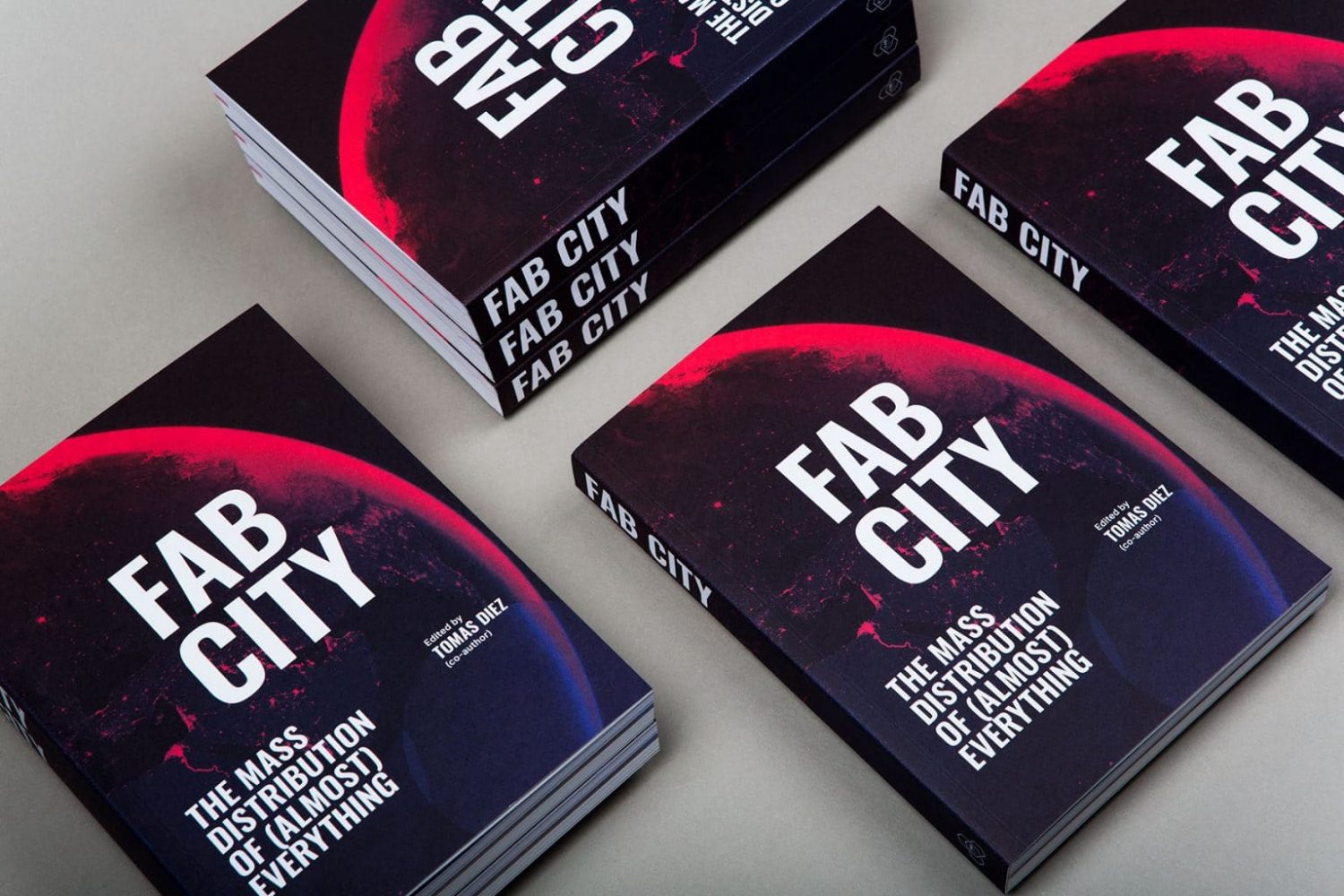

Fab City: The Mass Distribution of Almost Everything

A manual for making positive engaging urban futures possible

read more

RESOURCE

Fab City: The Mass Distribution of Almost Everything

A manual for making positive engaging urban futures possible

read more

RESOURCE

Fab City: The Mass Distribution of Almost Everything

A manual for making positive engaging urban futures possible

read more

🚀 Design for tomorrow: Explore MDEF!

New stories 👀 Read all about them!

Join us at 📍 FAB25 Czechia July 4–11 Brno & Prague!

🚀 Design for tomorrow: Explore MDEF!

New stories 👀 Read all about them!

Join us at 📍 FAB25 Czechia July 4–11 Brno & Prague!